Introduction

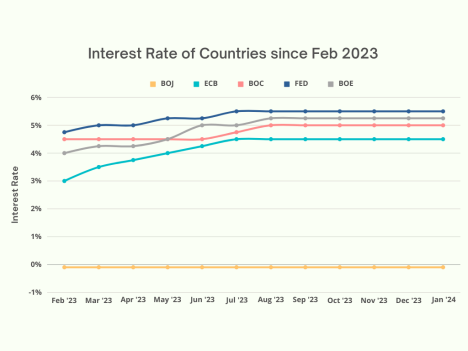

In the realm of monetary policy, the recent decisions by major central banks - Federal Reserve Bank (Fed), Bank of England (BOE), European Central Bank (ECB), Bank of Canada (BOC), and Bank of Japan (BOJ) to keep their current interest rates unchanged have sparked conversations about the potential implications for economic growth. This trend prompts an important question: Does an unchanged interest rate signal a potential slowdown in economic growth? This blog will delve into this context and explore the implications of stable interest rates on economic dynamics.

Interpretation of Unchanged Interest Rates

Economically speaking, an unchanged interest rate signals stability in the central bank's monetary policy stance. It suggests that the central bank is satisfied with the current state of the economy and doesn’t see an immediate need for further stimulus or tightening measures based on its economic objectives. The central bank believesinflation is under control and retains flexibility for future policy adjustments. It reflects a careful assessment of various economic factors and a strategic approach to monetary policy to achieve its price stability, full employment, and sustainable economic growth objectives.

Central Banks’ Stance on Interest Rate

| Central Bank | Interest Rate | Current Inflation | Inflation Goal |

| BOJ | -0.10% | 2.6% | 2% |

| ECB | 4.50% | 2.8% | 2% |

| BOC | 5% | 3.4% | 2% |

| FED | 5.50% | 3.4% | 2% |

| BOE | 5.25% | 5.1% | 2% |

The BOJ employed its interest rate unchanged at -0.1%, expressing confidence in the gradual improvement of inflation prospects to combat deflationary pressures, anticipating wage increases and moderate economic recovery.

The ECB being restrictive, upholds its interest rate unchanged at 4.5% with the aim to control inflation while providing stability for businesses to plan investments effectively.

Despite speculation, BOC maintains its 5% policy rate to counter inflationary pressures, emphasizing vigilance and caution. While higher rates may restrain spending and housing activity, they're deemed necessary for long-term stability.

Despite falling inflation, the Fed retains its key rate stable at 5.5%. Chair Powell emphasized the need for "greater confidence" in sustained decreases before considering rate cuts. The economy and labor market have shown resilience, reducing the urgency for rate cuts.

The BOE also opted not to change the rate from the 15-year high of 5.25%. Governor Bailey stressed the importance of more evidence that inflation would consistently meet the target before considering any adjustments since the economy is more cautious about robust pay growth, diminishing effects of lower energy prices, and potential external factors like shipping disruptions.

Deciphering the ground behind Unchanged Interest Rates

Primarily, all these countries have a prevailing common objective of 2% inflation. These economies endeavor to accomplish inflation control while Japan is combating its deflationary pressures. Hence, policymakers are adopting a cautious approach, aiming for sustainable inflation while considering crucial factors like GDP, labor market dynamics, and business investment to support economic recovery. The governments believe that they are progressing towards their target gradually and they await further reassurance for the need to adjust interest rates while having price stability as a common and prioritized goal.

Conclusion

As Central banks around the world choose to preserve their key rates, the implications ofunchanged interest rates on economic growth remain subject to debate. Contrary to assumptions, this decision is not directly linked to an imminent economic slowdown. Instead, central banks are emphasizing stable, cautious, and strategic economic management while considering diverse factors such as inflation targets, employment figures, prevailing economic conditions, and long-term fiscal goals. This deliberate approach highlights their commitment to making well-founded decisions, steering clear knee-jerk reactions to short-term economic fluctuations. In essence, the current interest rate stance is a thoughtful strategy aimed at fostering a resilient and balanced economic environment, with due consideration to prevailing challenges.