Understanding CFD trading: Myths Debunked, Profits Unleashed

- 28 Aug 2024

Introduction

Eager to explore the world of CFD trading? Our comprehensive guide, "Understanding CFD trading: Myths Debunked, Profits Unleashed!," is here which is crafted in a way to shine a light on this influential trading technique. We will walk you through the essentials of CFD - what they are, how they operate, and the exciting benefits they offer. But it doesn’t stop there; we also tackle common misconceptions head-on and equip you with everything you need to navigate the complexities of CFD trading confidently. Whether you are a seasoned trader or just starting, with NGCB at your side, you can unlock the true potential of CFDs and take your trading journey to the next level.

What is CFD?

A Contract for Difference (CFD) is a cutting-edge financial agreement where you trade on the price movements of financial instruments like stocks, indices, currency pairs, commodities, and cryptocurrencies without actually owning them. In essence, it's an agreement between you and your broker to exchange the difference in an asset's price movements from the start to the end of the trade. With NGCB, you can leverage this dynamic trading method to potentially achieve high returns with minimal capital through the power of leverage, while also requiring diligent risk management due to its high volatility, making it a flexible and exciting trading option.

How does CFD work: Decoding the Dynamics

Understanding the mechanics of CFD trading is crucial for any aspiring trader - from grasping how to speculate on the price movements of various financial assets without owning them to effectively managing the risks associated with leveraged positions. Here is a simple breakdown of how the CFD trading works-

1. Opening a trading position

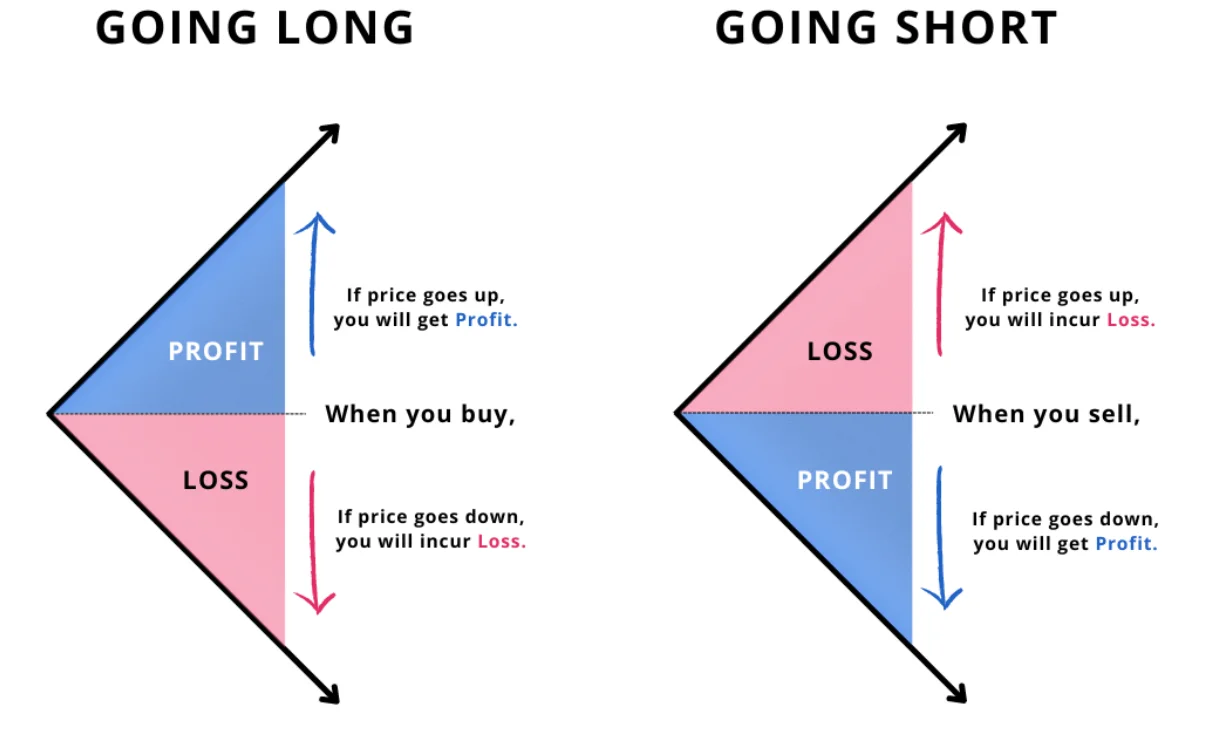

CFDs mirror the price of the underlying asset, enabling you to profit from both rising and falling prices. You can place trades based on your market outlook - buying (going long) when you expect a rise in price and selling (going short) when you foresee a fall.

2. Leverage

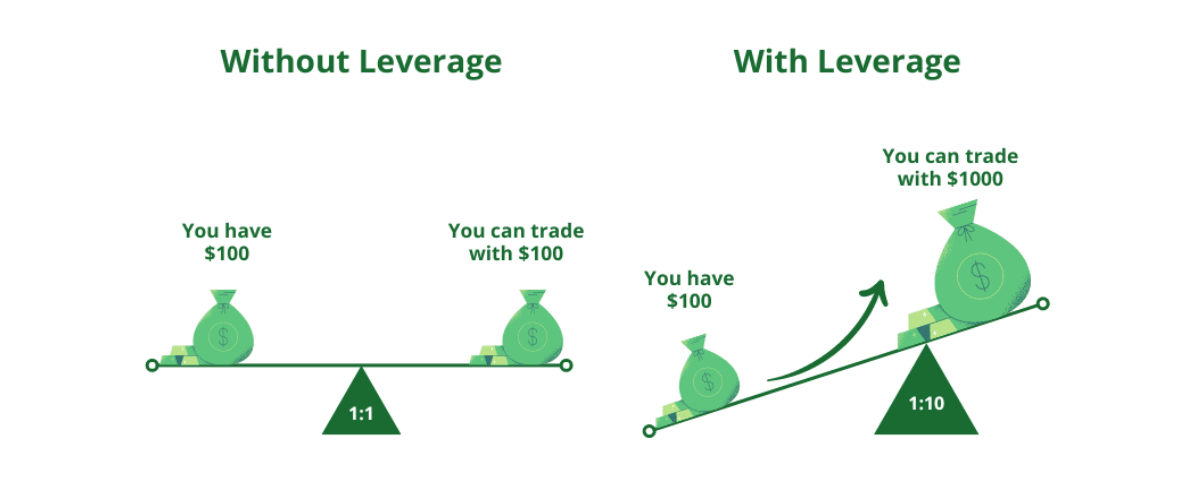

Leverage is a powerful tool in CFD trading that allows you to increase the size of your trading position with a relatively small amount of capital by using the borrowed funds from your broker.

When you use leverage, you only have to bring in a small percentage of your total trading

value which is known as Margin. This margin serves as a security deposit for the potential losses, while your broker lends you the remaining amount to open your trading position.

Leverage is usually expressed in a ratio, such as 1:10 which means for every $1 you invest, you can trade $10 worth of assets.

Suppose you have $1,000 in your trading account and decide to trade CFDs on a stock priced at $100 per share, without leverage, you could buy only 10 shares. With a leverage ratio of 1:10, you can trade $10,000 worth of stock with your $1000 deposit. This means you can buy 100 shares instead of just 10.

At NGCB, we offer flexible leverage options ranging from 1:100 to 1:500, empowering you to tailor your trading strategy to your specific needs and risk appetite. This flexibility enables you to maximize your trading opportunities while managing your exposure effectively. If your position moves against you and your account equity falls below the required margin level, you may receive a margin call, requiring you to deposit more funds or close positions to cover the shortfall.

3. Closing a Position

To close your trade, you do the opposite of your opening trade. If you bought at the start, you sell to close. Your net profit or loss is the difference between the opening and closing prices, adjusted for any fees.

Your profit or loss from a CFD trade will be realized when you close your position and it is calculated as,

● When it is buy position = No. of contracts * (Closing price - Opening price)

● When it is sell position = No. of contracts * (Opening price - Closing price)

For example,

You project the price of a stock will rise, so you buy 1 CFD contract when the stock price is $100.

● If the price goes up to $105, you make a profit which would be

1 contract × (105−100) = $5.

● If the price drops to $95, you incur a loss. Your loss calculation:

1 contract × (95−100) = −$5.

Conversely, you predict the price of stock will fall, so you enter a sell position when the stock price is $100.

● If the price goes down to $95, you make a profit. Your profit calculation:

1 contract × (100-95) = $5.

● If the price rises to $105, you incur a loss. Your loss calculation:

1 contract × (100-105) = −$5.

The Perks of CFD Trading: What Makes It Stand Out

● Leverage - This lets you trade larger trading positions with a smaller margin, unlocking your potential for significant returns. With NGCB, you can supercharge your larger positions with your modest margin and our leverage options ranging from 1:100 to 1:500.

● Flexibility - You can go long or short with ease on various instruments, profiting from both rising and falling markets and enabling effective trading strategies.

● 24/5 Global Market Access - CFDs offer access to a wide range of global markets, enabling around-the-clock trading from a single platform.

● Professional Execution - Access advanced order types and enjoy seamless execution with minimal or no fees, enhancing your trading precision.

● No Day Trading Limits - Say goodbye to capital restrictions and day trading limits. Open an account with a low deposit and start trading freely.

● Diverse Instrument Range - Trade a broad spectrum of financial instruments at NGCB, including stocks, indices, forex, and commodities, all via CFDs.

● Smart Hedging - Use CFDs to hedge against potential losses without selling your assets. Manage risk effectively and stay ahead of the market.

Why Smart Risk Management is Crucial

A well-defined risk management is a vital component of successful CFD trading, offering you the confidence to navigate market volatility with precision. By employing strategic toolslike stop-loss and take-profit orders, you can protect your investments from unexpected market swings and catastrophic events. Effective risk management also empowers you to optimize the right position sizes and leverage, ensuring that no single trade can adversely impact your overall portfolio. With a proactive approach to managing risk, you can unlock the full potential of CFDs, striking the perfect balance between risk and reward to reach your financial goals in this dynamic world of CFD trading.

Dispelling Common Myths in CFD Trading: Separating Facts from Fiction

Myth 1 - CFD is no different from Gambling

Fact - CFD trading is not a game of chance. It requires proper technical and fundamental analysis, strategic planning, informed decision-making, and disciplined risk management. Success relies on knowledge, preparation, and a thoughtful approach, rather than mere luck.

Myth 2 - CFD is only for Experts

Fact - While CFDs can seem complex, they are accessible to traders of all levels. To assist all the aspiring traders out there, our platform presents NG Academy with an extensive array of beginner-friendly go-to resources and demo accounts to make it easy for beginners to grasp

the essentials before diving into live trading. With our right guidance and support, you’ll be mastering CFDs confidently at your own pace.

Myth 3 - You need a lot of money to start trading with CFDs

Fact - CFD trading is more accessible than you might think, thanks to leverage. For instance, at NGCB, you can begin your trading venture with as little as $20 and can avail of leverage options ranging from 1:100 to 1:500, depending upon your deposit size. Just be sure to invest

wisely and understand how leverage works to make the most of your trading opportunities.

Myth 4 - High Leverage = High Risk

Fact - Leverage amplifies both potential gains and losses, but it doesn’t inherently mean high risk. By employing proper risk management strategies within your capacity, you can use leverage to your advantage without exposing yourself to undue risk. Plus, at NGCB, our

negative balance protection has you covered, so you can trade with peace of mind, knowing

you’re protected from losses exceeding your deposit.

Myth 5 - You can make profits only in bull markets

Fact - CFDs offer the flexibility to profit from both upward and downward market trends. With the ability to go short, traders can capitalize on falling markets, creating opportunities regardless of market direction.

Myth 6 - CFD trading is a Scam

Fact - CFD is a legitimate financial instrument used by traders worldwide. Although the industry has faced its unethical operators, the vast majority of CFD brokers are licensed by reputable financial authorities and overseen by strict regulatory bodies to protect traders and

ensure fair practices. By choosing a well-regulated broker like NGCB, you can confidently trade while staying protected from any potential scams.

Conclusion

As we conclude, it’s evident that this versatile trading tool can offer exciting opportunities for all traders. With a solid understanding of CFD mechanics and a strategic approach to risk management, you can make well-informed trading decisions in the market. By breaking common myths, we've shed light on the true nature of CFD trading, dispelling misconceptions and highlighting its potential for capitalization. As your trusted and dedicated CFD broker, NGCB is here to support you with expert guidance and the right resources from NG Academy, ensuring you have everything you need to seize opportunities and mitigate risks.

Let NGCB be your partner on this exciting path, elevating you to make informed decisions with confidence and turn your trading aspirations into reality. The world of CFDs is yours to conquer and NGCB is your trusted ally on this exhilarating path!

Happy trading!

Choose your operating system

Join us for the Gateway to Wealth Copy Trading Tutorial

You're being redirected to another page, it may takes upto 3 seconds