Retail Revolution the Rise of Individual Investors in the Indian Market

- 11 Jul 2024

Introduction

Welcome to the forefront of a financial revolution, where the digital ecosystem is not just

evolving but flourishing, powered by the unstoppable force of retail investors. In this

captivating exploration, we unravel the transformative impact of retail participation on the

digital web. Traditionally dominated by institutional players, the stock market now bears

witness to a surge in individual participation emphasizing to the financial world that every

transaction matters. Join us as we navigate through the exciting realm where retail investors

are not just players but pioneers in shaping the future of finance in the digital era.

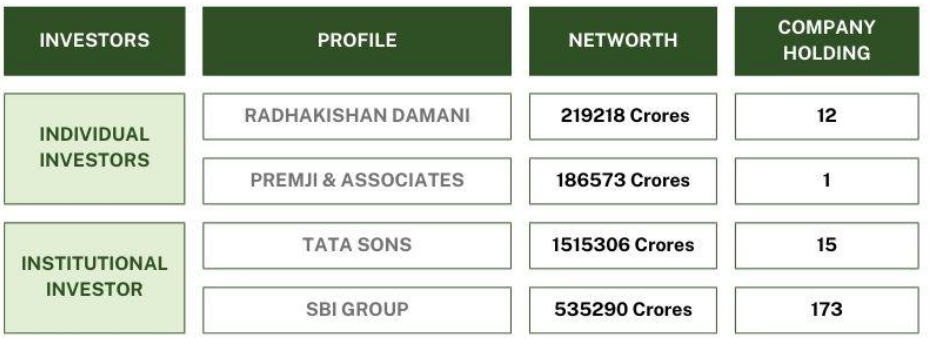

Individual Investors vs Institutional Investors

Retail investors and institutional investors are two divergent forces with contrasting

behaviors in sculpting the market dynamics. Retail investors, driven by diverse investment

goals and often react emotionally to market news, meanwhile, the institutional investors, with

their disciplined strategies and vast resources, bring a steady hand to the market. While both

groups are integral to market functioning, understanding the interplay between these two

players is essential for grasping the complexities of market behavior. Some major profiles

may include,

The Retail Investor Resurgence

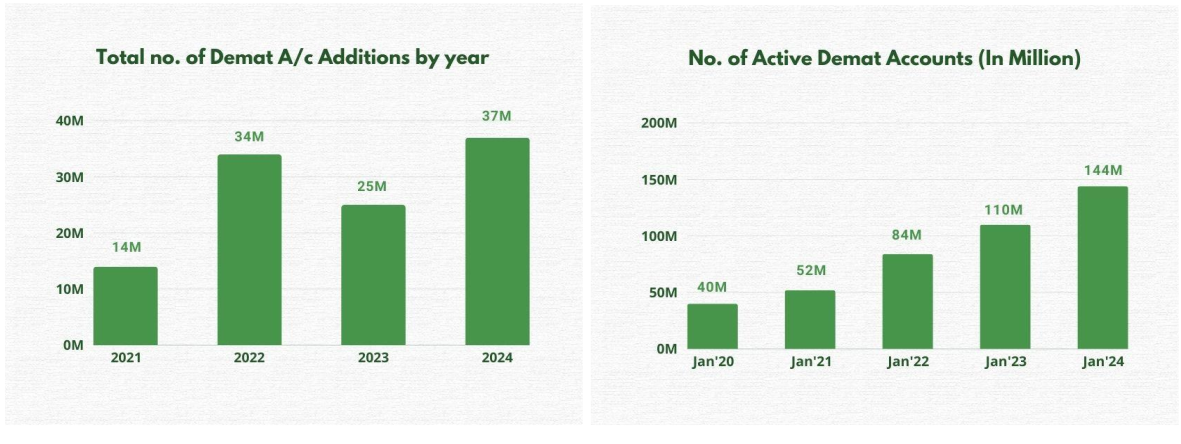

The Indian financial market is witnessing an impressive surge in retail investor participation,

highlighted by a significant increase in demat accounts and mutual fund inflows. Young

investors are notably active, investing in equities, mutual funds, and ETFs, contributing to a

robust market foundation despite challenges such as high foreign portfolio investor outflows.

The surge is evident through the significant rise in demat accounts, with a record 37 million new accounts opened in FY24 alone, bringing the total to 154 million by April 2024. This expanding retail investor base not only broadens the market but also enhances stability, reflecting a shift towards more dynamic and diversified investment strategies in India. Indian investors place predominant focus on stocks and gold reflecting a desire for strong returns, portfolio diversification, and long-term stability. By prioritising these key instruments, investors aim to balance growth and security in their portfolios.

Catalysts Fueling the Retail Investors Surge

● The advent of online trading platforms and mobile apps has made investing more

accessible and user-friendly to a broader audience. They offer simple interfaces andon-the-go access, enabling anyone with a smartphone and internet connection to participate in the stock market.

● Increased financial literacy and awareness have empowered more people to enter the stock market. Social media, financial blogs, online educational resources and awareness campaigns by financial institutions have played a crucial role in educating

individuals about investment strategies, market analysis, and the benefits of investing.

● The low-interest-rate environment has made traditional savings options less attractive, which now offer lower returns. Seeking higher returns, more people are turning to equities and mutual funds.

● The pandemic accelerated the trend of retail investing as lockdowns and remote work provided people with more time to explore investment opportunities. The market crash in early 2020 presented a buying opportunity, attracting many new retail investors.

● Young investors are increasingly willing to take on some risk by diversifying their portfolios beyond traditional assets like bank deposits and gold.

● The rising popularity of SIPs has grown significantly due to strong equity inflows have been a key factor in the rise of retail participation. SIPs reached an all-time high in contributions, making them a popular and beginner-friendly investment option.

● Simplified and secured rules and KYC norms have made it easier for individuals to start investing. The streamlined process requires fewer documents and can be completed quickly online.

These are the major elements that collectively contribute to the exceptional surge in retail investor participation in the Indian market, fostering a more inclusive and dynamic financial market landscape.

Impact of Surging Retail Participation In the progressing Indian financial market, a notable chapter unfolds as retail investors step into the limelight. From a mere 40 million demat accounts in March 2020, the count has surged to approximately 140 million by 2024, signaling a profound inflow of over 100 million new investors into the wealth creation journey. This surge isn't just a statistical

anomaly; it represents average monthly inflows exceeding Rs. 16600 crores, with SIP investments hitting a record Rs 18,838 crore in January 2024, marking a 36% year-on-yearincrease. It has undoubtedly led to higher market liquidity and increased trading volumes

signifying a noble shift in the ways individuals perceive and engage with financial markets.

Future of Retail Investing

The future of retail investing in India shines exceptionally promising, driven by a fusion of tech innovations, financial literacy, and regulatory backing. Now, retail investors have emerged a primary driving force, playing significantly ahead of FIIs at times. It gets evident with a recent contemporary instance - Following a significant market rally on June 3, 2024 driven by Exit Polls, NSE data reveals that retail investors offloaded shares worth Rs 8,588 crore, while FIIs and mutual funds collectively invested over Rs 10,000 crore. On June 4, following the announcement of the 2024 Lok Sabha election results, the Nifty plunged by 5.9%. During this period, retail investors displayed a strong buying sentiment, acquiring equities worth Rs 21,179 crore. In contrast, FIIs and mutual funds sold equities worth Rs 12,511 crore and Rs 6,249 crore, respectively.

Thus, the future of retail investing in India is poised for noteworthy growth and transformation.

Conclusion

Ultimately, the surge in retail investor participation marks a transformative period for the Indian stock market, reflecting a shift towards democratization of wealth creation. Looking ahead, the future holds promise for retail investors, with continued innovation and empowerment set to redefine India's investment landscape for years to come. To support you on this journey, NGCB offers a wealth of educational resources through the NGCB Academy, providing insights and knowledge to enhance your strategies. Additionally, by joining our regular webinars and seminars, you can stay updated on the latest market trends and opportunities. Join us on this thrilling journey towards unlocking your full financial potential!

- NGCB Team

Choose your operating system

Join us for the Gateway to Wealth Copy Trading Tutorial

You're being redirected to another page, it may takes upto 3 seconds