2024: A Year of Market Highs, Lows, and Unforgettable Shifts

- 05 Feb 2025

2024 Market Review: Navigating Highs and Lows with NGCB Group

2024: A year that was nothing short of a rollercoaster, defined by extraordinary highs and humbling lows in global financial markets. From groundbreaking economic policies that

reshaped investment strategies to disruptive geopolitical events that tested the resilience of even the most seasoned traders, 2024 was truly a year to remember! At NGCB Group, we strive to assist traders in navigating the ever-changing and unpredictable world of global finance. In this article, we’ll revisit 2024’s most remarkable moments—the triumphs that fueled ambitions and the challenges that demanded perseverance.

The Bright Spots of 2024: Triumphs That Defined the Year

1. The US Economy’s Remarkable Resilience

In 2024, the United States stood out as a beacon of economic strength, overcoming summer slowdown fears with an impressive 2.6% average GDP growth. The S&P 500 stole the show with a record-breaking 25% return, while the Nasdaq soared by 26%. The continued dominance of mega-cap tech giants like Apple and NVIDIA, driven by the AI revolution, remained the defining growth story of the year. Investments in generative AI and semiconductor technologies reinforced technology as the crown jewel of global markets, while earnings growth broadened across sectors, setting the stage for a promising 2025.

The political landscape also took center stage in November with Donald Trump’s re-election, sparking fresh waves of optimism and uncertainty. Investors cheered the potential for policy shifts favoring deregulation, energy, and infrastructure sectors that are poised to benefit most from a Trump administration. Trump’s return to the Oval Office marked a defining moment of the year, significantly altering market sentiment and adding another layer of complexity to the financial landscape.

2. Asia’s Powerhouses on the Rise

In 2024, Japan and China made remarkable strides in the global equity markets, with Japan emerging as the second-best performing major equity market, delivering an impressive 20.5% return. A blend of corporate reforms, a weak yen, and growing optimism about future economic growth fueled the rally, showcasing Japan's resilience despite global headwinds. With investors hoping that the country’s economic restructuring and reforms would pay off, Japanese equities stood out as an icon of growth in a turbulent global landscape. Additionally, Japan turned heads on the global stage with a bold move of ending its long-standing negative interest rate policy in 2024, reflecting its confidence in the economic recovery.

On the other hand, China, initially struggling with weak consumer confidence and falling property prices, staged an impressive turnaround in the latter half of the year. September's cohesive policy measures reignited investor confidence and hopes for 2025 drove Chinese equities to a 19.8% gain by year-end. The resurgence highlighted the country’s capacity to bounce back from adversity, and market sentiment turned positive as hopes of a strong economic revival in the near future gained traction.

3. Golden Shine in a Year of Uncertainty

In 2024, gold proved to be the shining star of uncertain times, gleaming brighter than ever, delivering a stunning 27.1% return and soaring past $2,700 per ounce. Amid growing fiscal concerns in the US triggered by inflation fears, rising bond yields, and the economic implications of the US election, gold became a refuge for investors seeking stability in the face of market volatility. The precious metal's stellar performance was further fueled by rising geopolitical tensions, particularly the Middle East tensions, the Ukraine conflict, and concerns surrounding China's economic recovery. With global central banks, notably China increasing their gold reserves and heightened investor anxiety, the precious metal reaffirmed its status as the ultimate safe haven.

Read More: Geopolitical Impact on Global Markets

4. High-Yield Bonds Keep Winning

High-yield bonds continued their winning streak for the fourth year in a row, offering impressive returns of over 8%. Amid a backdrop of rising government bond yields and persistent uncertainty in global financial markets, these bonds stood out as a reliable refuge for yield-hungry investors. The combination of high all-in yields and tightening credit spreads provided a lucrative opportunity for those willing to embrace slightly higher risk. As central banks began easing monetary policies, particularly in Europe, and with the US Federal Reserve adopting a more measured approach, high-yield bonds gained traction.

5. Cryptocurrency’s Electrifying Comeback

In the realm of digital assets, Bitcoin emerged as a true champion, surging by 120% over the year, skyrocketing to a new high above $100,000. A significant shift in the U.S. administration’s stance towards cryptocurrencies, coupled with increased institutional acceptance, breathed new life into the crypto market. This resurgence, following a challenging 2023, was further boosted by institutional adoption, growing regulatory clarity, and speculative buying, particularly after the US election results. Bitcoin’s impressive performance, alongside Ethereum’s 45% gains, symbolized renewed confidence in decentralized finance, attracting both retail and institutional investors who had previously been wary of this volatile space. As a result, Bitcoin validated its position as a key asset class, embodying both a hedge and a growth opportunity in the evolving financial landscape.

The Shadows of 2024: Challenges That Tested Resilience

1. Wall Street’s August Crash

On August 5th, Wall Street suffered one of its worst single-day sell-offs since March 2020, as recession fears gripped investors following July’s grim jobs report. The S&P 500 plunged over 3.5%, the Nasdaq tumbled more than 4%, and the VIX spiked past 25, reflecting heightened market anxiety. Tech stocks, which had fueled much of the year’s rally, saw billions wiped out within hours, with mega-cap giants like Apple, NVIDIA, and Tesla taking heavy losses. Bond markets also reacted sharply, with the 10-year Treasury yield briefly touching 4.5%, signaling deep uncertainty over future Fed policy. While markets later stabilized, the crash was a stark reminder of the fragility of investor sentiment in an environment dominated by inflation concerns, monetary policy shifts, and global economic uncertainty.

2. Geopolitical Turmoil and Market Disruptions

Geopolitical turmoil defined market movements in 2024, with escalating tensions in Ukraine and strained US-China relations fueling volatility. The prolonged Ukraine conflict kept oil prices above $90 per barrel, pressuring European economies with inflation. Meanwhile, US-China trade restrictions and semiconductor sanctions added uncertainty, dampening investor sentiment. Emerging markets underperformed, delivering just a 5.3% return, lagging behind the US and Asia. Heightened defense spending bolstered defense stocks, but broader markets remained fragile. Geopolitical shocks underscored the delicate balance between economic resilience and political stability. Investors navigated a landscape where uncertainty dictated market sentiment.

3. The Bond Market’s Tough Year

In 2024, global government bonds faced a tough year, delivering a -3.1% return as central banks slowed rate cuts. UK Gilts, with their long duration, were particularly vulnerable to rising yields, while Japan’s bonds struggled after the Bank of Japan ended its negative interest rate policy and yield curve control. Persistently high inflation and cautious monetary policies kept government bond yields rising, putting pressure on businesses and governments. The 10-year US Treasury yield reached 4.6%, while Treasury returns were muted at 0.7%, reflecting investor concerns about balancing growth with inflation. This divergence between the Federal Reserve's cautious stance and market expectations highlighted the challenges of stabilizing the economy.

4. Commodities Lose Their Spark

In 2024, commodities struggled to gain momentum, with a broad commodity index delivering a modest 5.4% return. The lack of demand from China, particularly amid its economic slowdown, dampened growth prospects for various sectors like oil, metals, and agricultural goods. While some commodities saw only limited gains, gold emerged as the standout performer, delivering an impressive 27.1% return and reaffirming its position as a safe-haven asset amid rising geopolitical tensions and fiscal concerns. The weakening demand from China and continued global uncertainties kept most commodity prices subdued, highlighting the challenges faced by this sector in 2024.

5. Federal Reserve’s Troubling Rate Cut Reversal

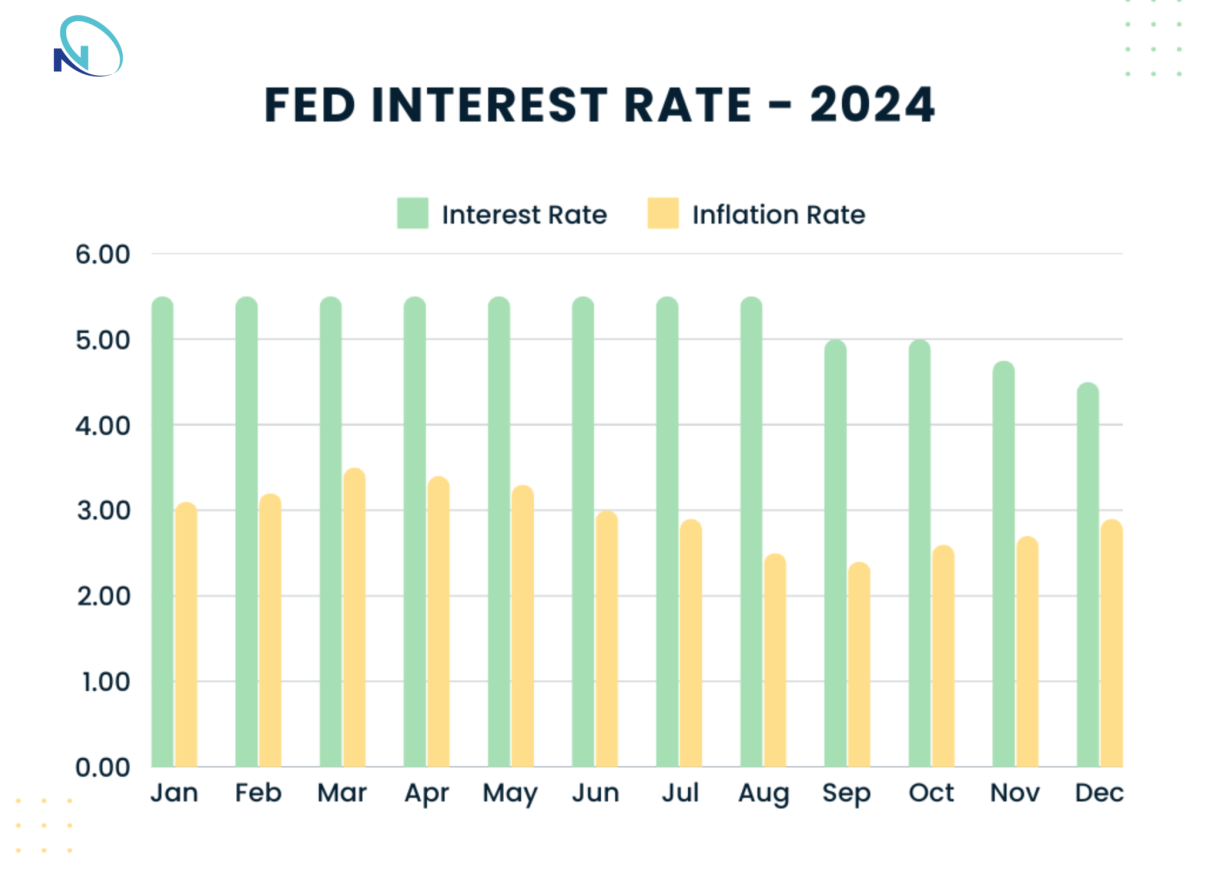

In September, the Federal Reserve made its first interest rate cut since the pandemic recovery, signaling concerns about the U.S. economy’s growth trajectory. Despite its intention to stimulate economic activity, the move raised alarms about underlying weaknesses, sparking fears of stagflation—where inflation persists despite stagnating growth. This shift came amid persistent inflationary pressures and high bond yields, which had already been putting a strain on markets and investors. The Fed's pivot was compounded by ongoing global uncertainties, including geopolitical tensions and a volatile financial landscape, which cast a shadow over the latter part of 2024.

Conclusion: A Year of Contrasts

2024 was a whirlwind year of triumphs and trials, where resilience and innovation fueled market highs while uncertainty tested investor confidence. The US economy defied expectations, tech stocks soared, Bitcoin shattered records, and gold reaffirmed its safe-haven status. Japan’s bold policy shift and China’s rebound injected fresh optimism, while AI remained a driving force. Yet, bond markets faltered, Europe struggled, and geopolitical tensions kept traders on edge. As we enter 2025, will AI, crypto and economic strengthsustain momentum, or will new challenges emerge? At NGCB Group, we remain committed to equipping traders with the insights to navigate this ever-evolving financial landscape.

Knowledge fuels success—Stay informed with us!

Choose your operating system

Join us for the Gateway to Wealth Copy Trading Tutorial

You're being redirected to another page, it may takes upto 3 seconds