The Power of Geopolitics: Exploring Its Impact on Global Markets

- 17 Oct 2024

Geopolitical Events for Global Markets

Introduction

In our interconnected global economic arena, markets always react to the intricate and volatile realm of geopolitics. From a trade war between major economies to a brewing military conflict, these events can send ripples through markets, disrupting everything from currencies to stock prices. Mastering this unpredictable landscape requires more than just tracking the news - it calls for a solid understanding of how geopolitics and market forces are entangled. But don't worry - at NGCB, we've always got your back as we're committed to keeping you ahead of the curve. That’s why we offer the resources and insights you need to navigate the complexities of the world where geopolitics and markets are more closely intertwined than ever.

What are Geopolitical Events?

A geopolitical event is a significant occurrence in global politics or international relations that can have a profound impact on economies and financial markets worldwide. These events encompass a wide range of situations, including elections, policy shifts, international trade disputes, military conflicts, and diplomatic negotiations. Each of these events has the potential to alter the balance of power, disrupt trade routes, impact investor confidence, and shift the direction of global markets. Understanding geopolitical events is crucial for anyoneinvolved in finance or economics, as they can lead to significant market volatility and create both challenges and golden opportunities for investors.

How do Geopolitical Events impact financial markets?

Geopolitical events are the game-changers that serve as stark reminders of the volatility they can inject into global markets. With over 50 elections and enduring conflicts around theworld this year (2024), these events are more than just news—they are key drivers of market volatility. From the 1973 oil crisis, which caused prolonged market turmoil, to ongoing Middle-East tensions, these events reveal their power to disrupt. While these events often seem sudden, they typically stem from long-simmering tensions, making them difficult to predict. However, by examining past events and utilizing tools like the Geopolitical Risk Index, we can gauge their potential impacts on economies and financial markets.

Safe Havens: Stabilisers Amid Market Chaos

A safe-haven asset is a financial instrument that retains or even increases in value during times of market turbulence, economic uncertainty, or geopolitical crises. Investors flock to safe havens like Gold, Yen, Dollar and Franc because these assets are perceived to provide protection against the volatility and risks that come with global instability. Gold, in particular, has an unique stand due to its intrinsic value, liquidity, and historical role as a store of wealth especially in times of conflict, such as the recent escalation between Israel and Palestine. This behavior is rooted in gold's ability to shine as a go-to hedge against currency devaluation, inflation, and the unpredictable swings in financial markets that geopolitical events can trigger. As tensions grow, so does the demand for gold, underscoring its timeless role as a refuge in uncertain times.

Case Studies: Insights from Recent Conflicts

Let’s explore how the latter geopolitical crises have spiked market volatility and shifted

investor behavior.

1. US-China Trade War

In the intense rivalry between the West and China, the competition extends economically, technologically, and ideologically, reshaping global dynamics. Western nations, from Europe to North America, are strategically addressing China's growing influence through trade policies, technological advancements, and heightened scrutiny of investments with both sides heavily investing in cutting edge innovations like AI and semiconductors. Meanwhile, China's increasing footprint in Europe has led to intensified regulatory measures and concerns over strategic sectors, exemplified by the U.S. CHIPS Act aimed at revitalizing its semiconductor industry and reducing dependency on Chinese production.

As this trade tension heats up, the world faces a crucial choice: smooth diplomacy or a return to trade wars. Amid this uncertainty, gold has soared past $2,000 an ounce, driven by fears of geopolitical strife and economic instability. With escalating risks from global conflicts and rising fiscal pressures, gold stands as the go-to haven, with its value expected to climb even higher as investors seek refuge from a turbulent economic landscape.

2. Russia - Ukraine Conflict

The conflict between Russia and Ukraine cast a long shadow over the global economy, with ripple effects felt far beyond the battlefield. Stock market data revealed that companies with significant ties to Russia, whether through trade or ownership, experienced notable declines in value. The effects are most pronounced in sectors like energy, where dependence on

Russian imports, such as fossil fuels, is challenging to substitute. The repercussions are not just limited to Ukraine and Russia; they extend across Europe, highlighting the

interconnectedness of global trade and the risks of economic entanglement with politically unstable regions.

The war dramatically shook up global commodity markets, with two main forces at play: the physical disruption of supply chains and the sweeping sanctions against Russia. As major exporters of vital commodities like wheat, natural gas, and fertilizers, Russia and Ukraine's turmoil rippled across the globe. The European Union, heavily reliant on Russian energy, faced severe shortages, while many emerging markets are struggling with food supply disruptions. The conflict has already led to plummeting Russian oil prices, halted Ukrainian

wheat exports, and a looming global fertilizer shortage, threatening to worsen the food crisis in vulnerable regions.

3. Middle East Tensions

While concerns about a major escalation in the Middle East persist, strong global demand and OPEC+ (Organization of the Petroleum Exporting Countries) output cuts have pushed Brent crude prices above $90 per barrel in April 2024, fueling volatility and investor anxiety. OPEC's significant spare capacity, particularly in Saudi Arabia, and the Gulf states' dominant interest in maintaining regional stability, suggest that any disruption in Iranian oil exports could be offset. Additionally, the strategic importance of the Strait of Hormuz, through which 30% of the world’s seaborne oil trade passes, makes a closure by Iran unlikely, as it would severely harm Iran's own economy and relations with key trading partners like China. In terms of global economic implications, while a spike in oil prices could contribute to inflationary pressures, especially in strong economies with tight labor markets, central banks may slightly delay monetary easing due to these inflationary effects.

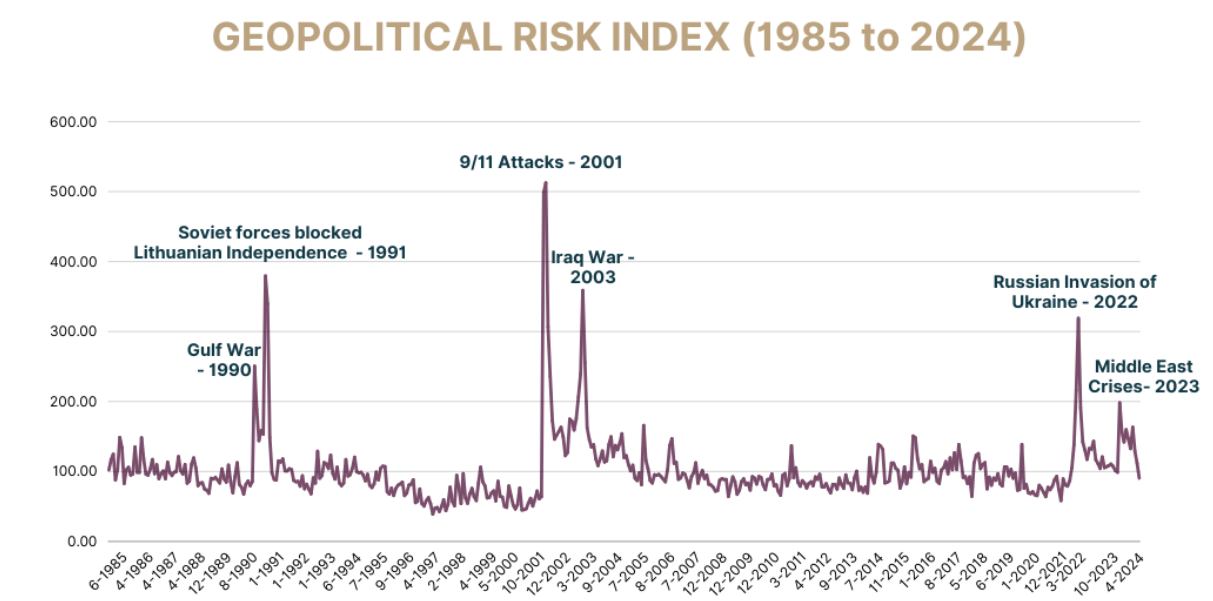

Geopolitical Risk Index: A Barometer for Global Tensions

The Geopolitical Risk Index (GPR) is a tool that tracks the pulse of global tensions, keeping tabs on how political drama, conflicts, and instabilities impact markets and economies. Byscanning the news for the frequency of geopolitical buzzwords, GPR gives a snapshot of the world's biggest risks, helping everyone from investors to policymakers stay ahead of the curve in uncertain times. Here is the GPR data ranging from 1985 to 2024 capturing the key events:

Tips to safeguard your Portfolio against Geopolitical Tensions

1. Diversify Your Portfolio

Geopolitical events can cause sudden market shocks. Spread your investments across various sectors, asset classes, and geographies to reduce risk exposure.

2. Stay Informed

Keep a close eye on the news, especially in regions with rising tensions. Being proactive allows you to adjust your strategy before market reactions hit.

3. Use Safe-Haven Assets

Gold, government bonds, and stable currencies like the USD areoften go-to options during global instability. Allocate a portion of your portfolio to these

assets for stability.

4. Hedge with CFDs

Consider using Contracts for Difference (CFDs) to hedge your positions as they allow traders to profit from both rising and falling markets without owning

the underlying asset.

5. Limit Leverage

In volatile times, excessive leverage can amplify losses. Keep your leverage levels conservative to minimize risk during uncertain market conditions.

Staying prepared and proactive is key to navigating market turbulence caused by geopolitical tensions !

Conclusion

In conclusion, the ever-changing landscape of global markets highlights the importance of staying informed about geopolitical developments and their potential impact on financial

assets. Investors must remain vigilant, adapting their strategies to manage the volatility that often accompanies these events. In such times, having access to reliable insights and educational resources becomes crucial for making informed decisions. That’s why our platform offers access to the NG Academy as we understand the challenges that traders face

in navigating global markets. Our academy is designed to empower traders with the knowledge and tools they need to make smart trading moves. Whether you’re a beginner or

an experienced trader, NGCB is committed to providing you with the resources necessary to thrive in today’s complex trading environment. Stay ahead with NGCB – where knowledge

meets opportunity!

Choose your operating system

Join us for the Gateway to Wealth Copy Trading Tutorial

You're being redirected to another page, it may takes upto 3 seconds