Market Pulse: A Beginner's Guide to Indices Trading

- 09 Dec 2024

What are indices and how do you trade them?

Imagine tracking the heartbeat of the economy with a single instrument! Welcome to the world of indices, where you can measure the performance of the entire market at a glance and profit from the rise or fall of the world’s biggest economies and industries. As a beginner, you might wonder: How does it work? What drives indices? What strategies should I use? How can I navigate this dynamic market as a beginner? Don’t worry, we’ll break it all down for you, step by step, and in simple terms. Ready to turn market movements into opportunities with NGCB? Let’s dive in and set you on the path to mastering indices trading!

What are Indices?

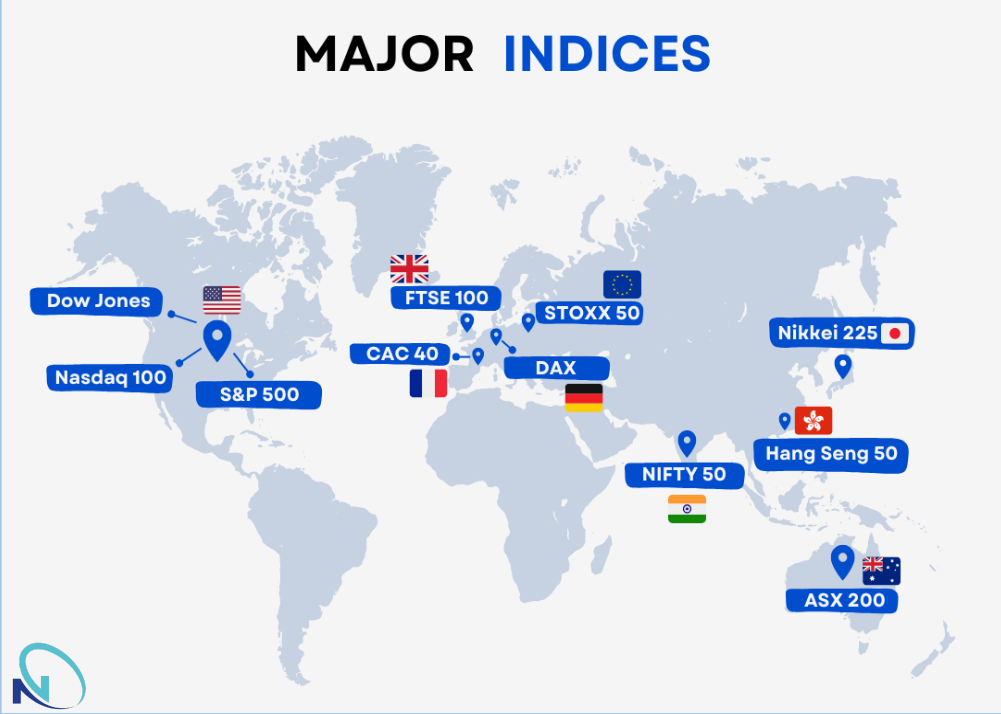

Indices are snapshots of the market, designed to track the performance of a group of stocks. An index is a collection of stocks that represents the overall movement of a particular sector, market, or economy. Rather than focusing on individual stocks, indices serve as a powerful indicator, reflecting broader market trends, economic shifts, and investor sentiment. Each index is calculated based on various factors, like stock price or market capitalization (the total value of all companies in an index, calculated by multiplying stock price by the number of shares outstanding). For example, the S&P 500 includes 500 of the largest companies in the US, offering a clear picture of the American stock market’s health.

Why Trade Indices?

Here are some sound reasons why trading indices can be a smart choice:

● Trading indices offer diversification, allowing you to profit from the overall performance of a group of companies, rather than the success or failure of a single one.

● Indices let you trade markets around the world, allowing you to benefit from different regions, such as the U.S., Europe, or Asia.

● You can profit from both rising and falling markets, with CFDs.

● Indices like the S&P 500 or Nasdaq 100 are among the most traded globally, ensuring high liquidity, allowing for easy entry and exit and tighter spreads for cost-effective trading.

● Indices are more volatile as they often respond sharply to major economic and geopolitical events, providing traders with opportunities to capitalize on short-term market movements.

● Indices trading often allows for leveraged positions, enabling you to control larger market exposure with a smaller initial investment.

● Indices can be used to hedge against portfolio risks, protecting investments from adverse market conditions by offsetting potential losses.

How are Indices compiled?

Indices are compiled based on various types of assets, each serving a different purpose and providing insights into specific markets or sectors. Here are the main types of bases on which indices are compiled:

● Stock Indices

- These indices serve as a barometer of a bundle of stocks within a specific market segment. They are the most common type and include examples like the S&P 500 (U.S. large-cap stocks), Dow Jones Industrial Average (30 major U.S. companies), and Nikkei 225 (top Japanese companies).

● Commodity Indices

- These indices provide insights into the price movements of raw materials such as oil, gold, and agricultural products. Examples include the Bloomberg Commodity Index and S&P GSCI (Goldman Sachs Commodity Index).

● Currency Indices

- These indices track the value of a particular currency against a basket of other major currencies. For instance, DXY (U.S. Dollar Index) measures the strength of the USD compared to six other major currencies.

● Sector Indices

- They focus on market behaviour of specific industries, such as technology, healthcare, energy or finance to help investors and traders assess the activity of a particular industry. Examples include the NASDAQ Biotechnology Index and the

S&P 500 Financials.

● Bond Indices

- These indices measure the performance of fixed-income securities, such as government or corporate bonds. The Bloomberg Barclays U.S. Aggregate Bond Index is a key example, helping investors gauge the bond market trends.

● Volatility Indices

- These indices measure market volatility rather than price levels. The CBOE Volatility Index (VIX), known as the "fear gauge," reflects the market’s expectations for future volatility and is used as an indicator of investor sentiment. Each type of index offers unique insights into different market areas, allowing traders and investors to choose based on their focus, whether it’s stock trends, commodity prices, or overall economic stability.

Key Factors That Affect Indices Trading

Indices trading is influenced by a variety of elements that cause significant movements in their value. Understanding these key components helps you make informed decisions and better anticipate market changes:

1. Economic Data Releases

- Reports on GDP growth, unemployment rates, inflation, and consumer confidence can impact the overall market sentiment. Strong data often lifts indices, while weak data can lead to declines.

2. Corporate Earnings Reports

- Stock indices are impacted by earnings reports from the key companies within them. Strong, better-than-expected earnings can push an index higher, while weaker results can pull it down.

3. Interest Rates and Central Bank Policies

- Decisions by central banks, such as the Federal Reserve or European Central Bank, regarding interest rates and monetary policy, have a significant impact on indices.

4. Geopolitical Events

- Political tensions, trade agreements, conflicts, unexpected policy changes, elections, sanctions or wars create market uncertainty, leading to index volatility and potentially boosting or weakening broader market segments.

5. Market Sentiment and Investor Confidence

- Indices are heavily affected by shifts in investor and trader sentiment, whether optimism or caution. Positive sentiment can drive indices up, while fear can lead to sell-offs.

6. Global Market Trends

- Indices are often influenced by major international market trends. For instance, significant overnight movements in Asian markets can impact European and U.S. indices when they open, as global interconnectedness creates ripple effects.

7. Commodity Prices

- Fluctuations in commodity prices can affect indices, especially those with heavy exposure to energy, mining, or agricultural sectors. For example, a surge in oil prices might boost energy-heavy indices but negatively impact consumer-focused ones.

8. Currency Strength

- Changes in currency value can impact companies’ profitability, especially those involved in export and import. Indices in strong export-driven economies may be affected by a stronger or weaker domestic currency, influencing overall performance.

9. Technological Developments and Innovations

- Breakthroughs or setbacks in technology can influence indices that are heavily weighted toward tech stocks, such as the NASDAQ

100. Positive news can drive up these indices, while negative news may result in declines.

10. Government Policies and Regulations

- New policies or regulations, such as tax changes, trade tariffs, or environmental mandates, can impact industries and, by extension, indices that are highly correlated with those sectors. By keeping an eye on these factors, traders can better anticipate potential market movements and adjust their strategies accordingly.

Indices Trading Strategies

Trading indices offer various opportunities for profit, and selecting the right strategy is key to success. Here are some popular approaches:

1. Day Trading

- This involves buying and selling indices within the same trading day to capitalize on short-term price movements.

• When to go for it

-During high market volatility and major news events as it provides opportunities for quick profits from intraday price swings.

-When you have time to monitor.

-When you have a solid understanding of the index you're trading, including its historical patterns, common catalysts, and typical intraday movements.

• When to avoid it

-If you can’t dedicate the time for constant monitoring.

-During flat or low-volatility markets with limited price movement.

2. Swing Trading

- Swing trading aims to capture short to medium-term trends, holding positions for several days or weeks. It requires a balance of technical and fundamental analysis to identify trends.

• When to go for it

-When markets exhibit clear trends over days or weeks.

-If you want a more relaxed trading approach.

-When you have patience to hold trades for days, resisting intraday noise.

• When to avoid it

-In unpredictable, sideways-moving markets with no clear trends.

-If you lack patience or overreact to short-term market moves.

3. Hedging

- Hedging involves taking positions in indices to offset potential losses in your portfolio. It requires a clear understanding of portfolio risk and correlation with indices.

• When to go for it

-During market uncertainty to protect against potential losses.

-When you want to lock in gains or reduce exposure to volatility.

• When to avoid it

-In calm, predictable markets where hedging might reduce profits.

-If you don’t fully understand how hedging instruments work.

4. Breakout Trading

- Breakout trading is entering trades when indices break through key support or resistance levels, signaling strong momentum. It obligates identifying key technical levels, monitoring for breakouts and quick action to enter trades as soon as breakouts are confirmed.

• When to go for it

-During periods of high volatility or after significant news events.

-When markets are trending strongly in one direction.

• When to avoid it

-In low-volatile markets where false breakouts are common.

-If you’re uncomfortable with rapid price movements.5. Range Trading

- Range trading focuses on buying and selling within a defined price

range. It necessitates stable, sideways-moving markets and basic technical analysis skills.

• When to go for it

-In low-volatility markets with clearly defined price ranges.

-When indices are consolidating within a defined price range.

-When you have the patience and discipline to stick to the range.

• When to avoid it

-During trends or breakouts where ranges don’t hold.

-In highly volatile markets where prices breach support or resistance frequently.

Conclusion

By understanding how indices work, mastering key strategies, and staying mindful of the factors that influence market movements, you can confidently navigate this dynamic trading avenue. Remember, success in indices trading lies in continuous learning, disciplined risk management, and adapting to market trends. Whether you’re a day trader seeking quick opportunities or a long-term strategist aiming to hedge risks, indices trading provides a versatile platform to achieve your goals. So, are you ready to take the next step with NGCB and explore the opportunities indices trading has to offer? With the right knowledge and tools, the world of indices is yours to explore!

Choose your operating system

Join us for the Gateway to Wealth Copy Trading Tutorial

You're being redirected to another page, it may takes upto 3 seconds